What Am I Worth?

One of the first things you question when you go freelance is how much to charge. You might be tempted to just match what an employee of your calibre earns, but you’ll quickly learn that you need to account for lots of other costs associated with running your own thing.

The Payoneer 2023 Freelancer Insights Report surveyed over 2,000 freelancers across 122 countries and found that many are still undercharging. We want to be competitively priced, but often end up underpricing due to lack of confidence, forgetting about non-billable time, and not accounting for the feast-and-famine nature of freelance income.

So, What Are The Hidden Costs of Freelancing?

Unlike employees who get paid for 40 hours regardless of productivity, freelancers only get paid for work that directly benefits clients. The rest; business development, admin, learning, and downtime, comes out of your billable rate. That stings if you don’t get it right!

Time you typically can’t bill clients for:

- Finding and pitching new clients (~10-20% of your time)

- Administrative tasks and invoicing (~5-10%)

- Professional development and skill updates (~5-10%)

- Sick days and vacation time

- Gaps between projects

Most freelancers can realistically bill 60-80% of their working hours. If you work 40 hours a week, maybe 25-30 of those directly generate income. So you’re already looking at 20-40% more just to match what an employee in the same role earns.

Location Matters

Freelance rates vary dramatically by region. According to the Payoneer 2023 Freelancer Insights Report, freelancers in North America average the equivalent of US$56/hour, while those in Western Europe earn around US$27/hour and Asia Pacific freelancers average US$20/hour.

This isn’t just about cost of living—it reflects market demand, client budgets, and economic conditions. The global average sits at $23/hour, but that number hides significant regional variations.

Obviously if you can be a digital nomad somewhere with a very low cost of living, working for US clients, you’re winning extra hard.

A Few Things People Miss

- Taxes. You’re on your own for these — often 25-35% of income. Factor it in or you’ll have a very unpleasant surprise come tax time.

- Slow periods. Freelance income is lumpy. Your rate needs to cover the quiet months too, not just the busy ones.

- Raising your rate feels scarier than it is. Restaurants don’t email you when the menu goes up. Your plumber doesn’t call to justify their new hourly rate. You don’t need to either.

Calculated Your Rate, Now What?

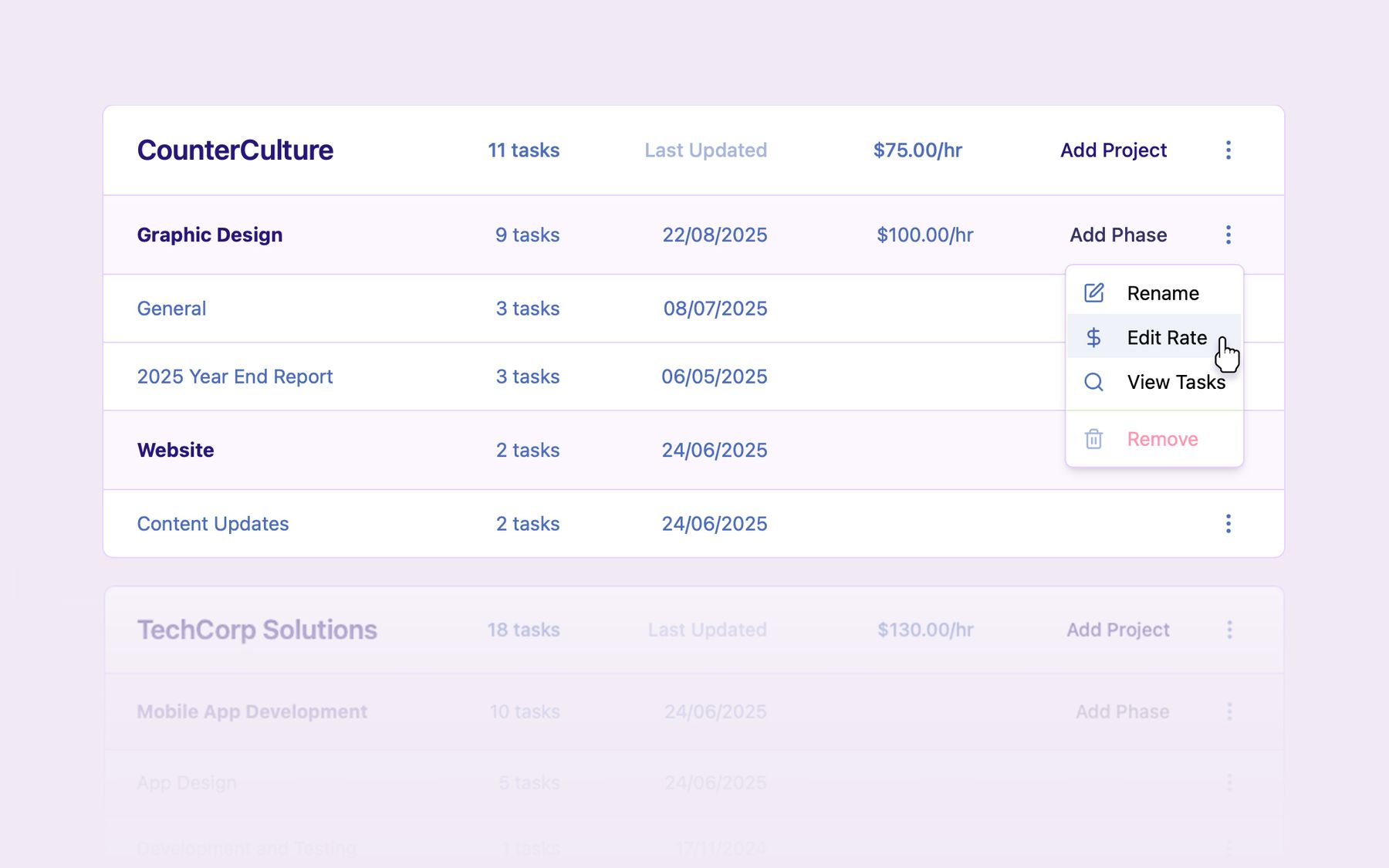

Your hourly rate above is a starting point. In practice you’ll probably charge different rates for different situations — a premium for demanding work, less for a long-term retainer, that sort of thing. TallyHo lets you set your default rate, then override it per client or project. The most specific rate always wins.

TallyHo — simple time tracking for freelancers. No timers, no guilt. Just an honest record of your day.